Understanding Investor Mortgage Loan Rates: A Comprehensive Guide for Real Estate Investors

#### Investor Mortgage Loan RatesInvestor mortgage loan rates refer to the interest rates applied to loans taken out by individuals or entities for purchasi……

#### Investor Mortgage Loan Rates

Investor mortgage loan rates refer to the interest rates applied to loans taken out by individuals or entities for purchasing investment properties. These rates can vary significantly based on several factors, including the type of property, the borrower’s creditworthiness, and the overall market conditions. For real estate investors, understanding these rates is crucial for making informed financial decisions and maximizing returns on investment.

#### The Importance of Investor Mortgage Loan Rates

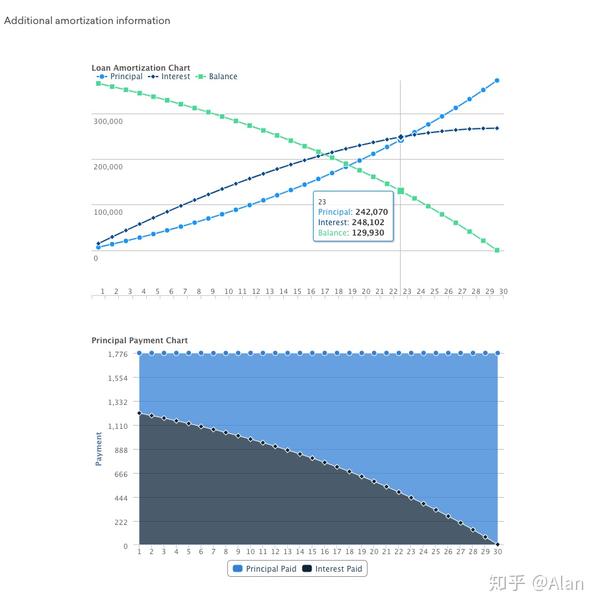

When considering an investment property, the interest rate on a mortgage can greatly influence the overall profitability of the investment. Higher rates can lead to increased monthly payments, which can eat into rental income. Conversely, lower rates can enhance cash flow and provide more room for profit. Therefore, it’s essential for investors to shop around and compare different lenders to secure the most favorable terms.

#### Factors Affecting Investor Mortgage Loan Rates

Several key factors can affect investor mortgage loan rates:

1. **Credit Score**: Lenders typically assess the borrower’s credit score to determine risk. A higher credit score often translates to lower interest rates, as it indicates a lower likelihood of default.

2. **Down Payment**: The size of the down payment can also impact the rate. A larger down payment may result in a lower interest rate, as it reduces the lender’s risk.

3. **Property Type**: Different types of investment properties (single-family homes, multi-family units, commercial properties) may have varying rates. Generally, more complex properties may come with higher rates due to increased risk.

4. **Loan Type**: The type of mortgage (fixed-rate vs. adjustable-rate) also influences rates. Fixed-rate mortgages provide stability, while adjustable-rate mortgages may offer lower initial rates but can fluctuate over time.

5. **Market Conditions**: Economic factors, such as inflation and the Federal Reserve’s interest rate policies, play a significant role in determining overall mortgage rates.

#### How to Secure the Best Investor Mortgage Loan Rates

To secure the best investor mortgage loan rates, investors should consider the following strategies:

- **Improve Credit Score**: Before applying for a mortgage, take steps to improve your credit score by paying down debts and ensuring timely payments.

- **Increase Down Payment**: If possible, aim to make a larger down payment to reduce the loan-to-value ratio and potentially lower your interest rate.

- **Shop Around**: Don’t settle for the first offer. Compare rates from multiple lenders, including banks, credit unions, and online lenders.

- **Consider Loan Terms**: Evaluate different loan terms and types to find the best fit for your investment strategy. Sometimes, a slightly higher rate on a shorter loan term can be more beneficial in the long run.

- **Stay Informed**: Keep an eye on market trends and economic indicators that may affect mortgage rates. Being informed can help you time your purchase for the best rates.

#### Conclusion

In summary, understanding investor mortgage loan rates is essential for anyone looking to invest in real estate. By considering the factors that influence these rates and employing strategies to secure the best terms, investors can enhance their financial outcomes and build a successful property portfolio. Whether you are a seasoned investor or just starting, knowledge of mortgage loan rates will empower you to make sound investment decisions.