Unlock Financial Freedom with Bill Doctor Loans: Your Path to Affordable Medical Expenses

Guide or Summary:Introduction to Bill Doctor LoansWhat Are Bill Doctor Loans?Bill Doctor Loans are personal loans specifically tailored for medical expenses……

Guide or Summary:

- Introduction to Bill Doctor Loans

- What Are Bill Doctor Loans?

- Bill Doctor Loans are personal loans specifically tailored for medical expenses. They can cover a wide range of costs, from hospital bills and outpatient procedures to prescription medications and rehabilitation services. Unlike traditional loans, which may come with strict requirements and lengthy approval processes, Bill Doctor Loans are often more accessible and flexible, catering to those who need immediate financial assistance.

- Benefits of Bill Doctor Loans

- How to Apply for Bill Doctor Loans

Introduction to Bill Doctor Loans

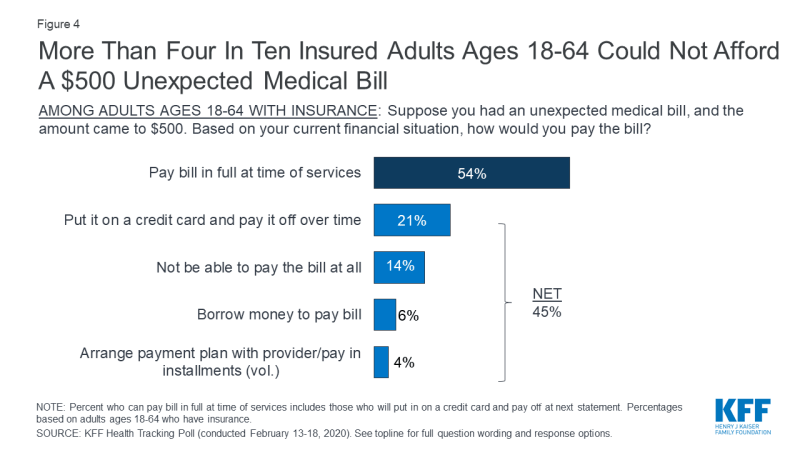

In today's fast-paced world, medical expenses can often catch us off guard. Whether it's an unexpected emergency or a planned procedure, the financial burden can be overwhelming. This is where Bill Doctor Loans come into play. These specialized loans are designed to help individuals manage their medical bills effectively, providing them with the financial relief they need to focus on their health rather than their finances.

What Are Bill Doctor Loans?

Bill Doctor Loans are personal loans specifically tailored for medical expenses. They can cover a wide range of costs, from hospital bills and outpatient procedures to prescription medications and rehabilitation services. Unlike traditional loans, which may come with strict requirements and lengthy approval processes, Bill Doctor Loans are often more accessible and flexible, catering to those who need immediate financial assistance.

Benefits of Bill Doctor Loans

1. **Quick Approval Process**: One of the most significant advantages of Bill Doctor Loans is the quick approval process. Many lenders understand the urgency of medical situations and offer expedited services to ensure that you receive the funds when you need them most.

2. **Flexible Repayment Terms**: Bill Doctor Loans come with various repayment options, allowing borrowers to choose a plan that best fits their financial situation. Whether you prefer a short-term loan with higher monthly payments or a longer-term loan with lower payments, there are options available to suit your needs.

3. **Lower Interest Rates**: Compared to credit cards and other high-interest loans, Bill Doctor Loans typically offer lower interest rates. This can save you a significant amount of money in the long run, making it easier to manage your medical expenses without falling into debt.

4. **No Collateral Required**: Most Bill Doctor Loans are unsecured, meaning you don’t have to put up any assets as collateral. This reduces the risk for borrowers, allowing you to access funds without the fear of losing your property.

How to Apply for Bill Doctor Loans

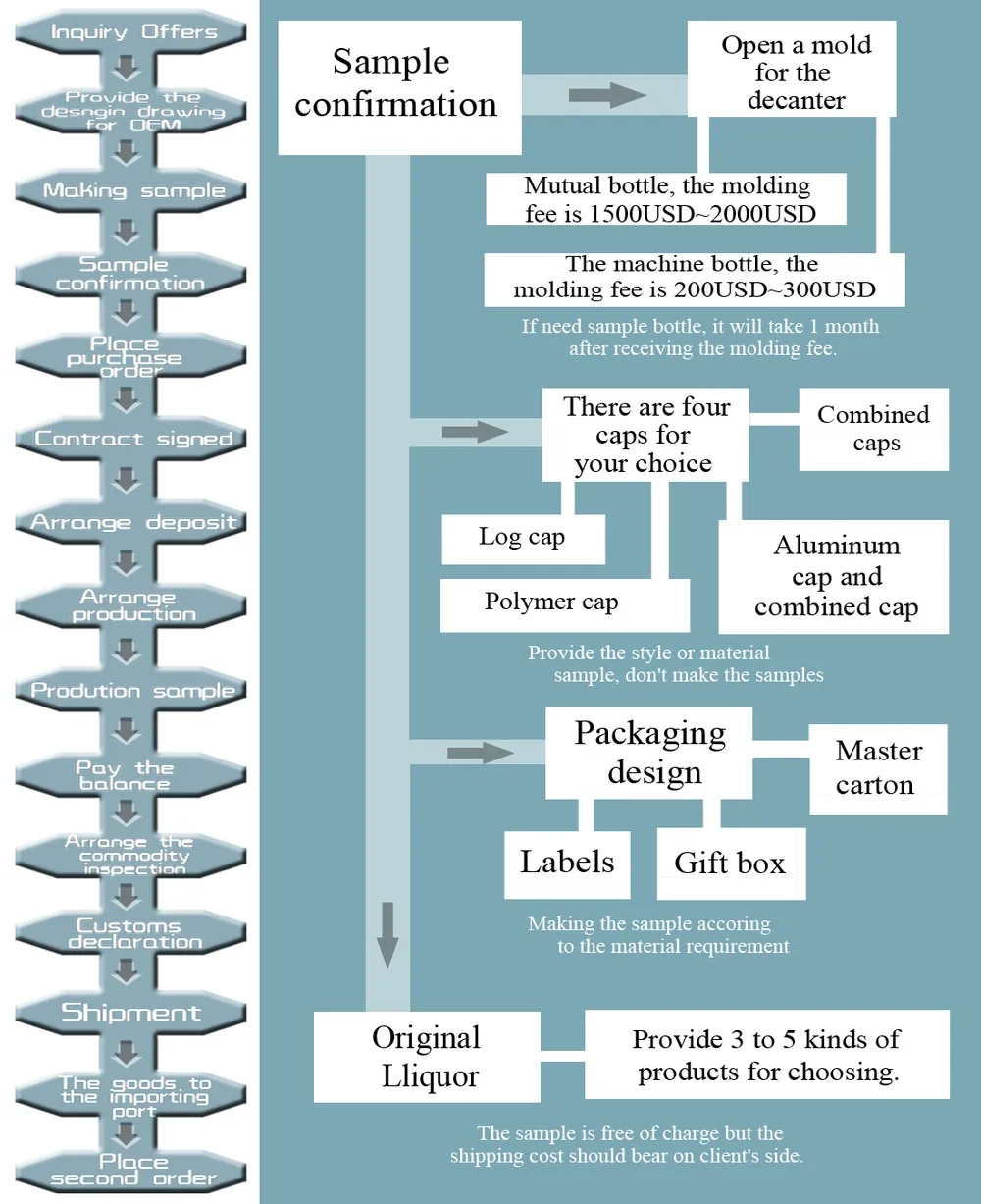

Applying for Bill Doctor Loans is a straightforward process. Here’s a step-by-step guide to help you get started:

1. **Research Lenders**: Look for reputable lenders that offer Bill Doctor Loans. Compare interest rates, repayment terms, and customer reviews to find the best option for your needs.

2. **Gather Documentation**: Prepare the necessary documents, such as proof of income, identification, and medical bills. Having everything ready will speed up the application process.

3. **Submit Your Application**: Fill out the application form provided by the lender. Ensure that all information is accurate to avoid delays.

4. **Review Loan Terms**: If approved, carefully review the loan terms and conditions. Make sure you understand the interest rate, repayment schedule, and any fees associated with the loan.

5. **Receive Your Funds**: Once you accept the loan offer, the funds will typically be disbursed quickly, allowing you to pay your medical bills without delay.

In conclusion, Bill Doctor Loans offer a viable solution for individuals facing unexpected medical expenses. With their quick approval process, flexible repayment options, and lower interest rates, these loans can provide the financial relief you need to focus on your health. If you find yourself in a situation where medical bills are piling up, consider exploring Bill Doctor Loans as a means to regain control of your financial situation and prioritize your well-being.