How to Get a Loan When Self Employed: Unlocking Financial Opportunities for Freelancers and Entrepreneurs

Guide or Summary:IntroductionUnderstanding Your Financial SituationImproving Your Credit ScoreExploring Different Loan OptionsGathering Required Documentati……

Guide or Summary:

- Introduction

- Understanding Your Financial Situation

- Improving Your Credit Score

- Exploring Different Loan Options

- Gathering Required Documentation

- Choosing the Right Lender

- Preparing for the Application Process

Introduction

Navigating the world of finance can be particularly challenging for self-employed individuals. Whether you're a freelancer, a small business owner, or an entrepreneur, securing a loan can often feel like an uphill battle. However, understanding how to get a loan when self employed can open doors to numerous financial opportunities. In this guide, we will explore the essential steps, tips, and strategies to help you successfully obtain a loan, even when your income is not as predictable as that of a traditional employee.

Understanding Your Financial Situation

Before diving into the loan application process, it's crucial to have a clear understanding of your financial situation. Self-employed individuals often have fluctuating incomes, making it essential to demonstrate your financial stability to lenders. Start by gathering your financial documents, including tax returns, profit and loss statements, and bank statements from the past few years. This information will help you present a comprehensive view of your financial health and establish your credibility as a borrower.

Improving Your Credit Score

Your credit score plays a significant role in determining your eligibility for a loan. Lenders use this score to assess your creditworthiness. If you're wondering how to get a loan when self employed, one of the first steps is to check your credit report for any discrepancies. Pay down existing debt, make timely payments, and avoid taking on new debt before applying for a loan. A higher credit score can significantly improve your chances of securing favorable loan terms.

Exploring Different Loan Options

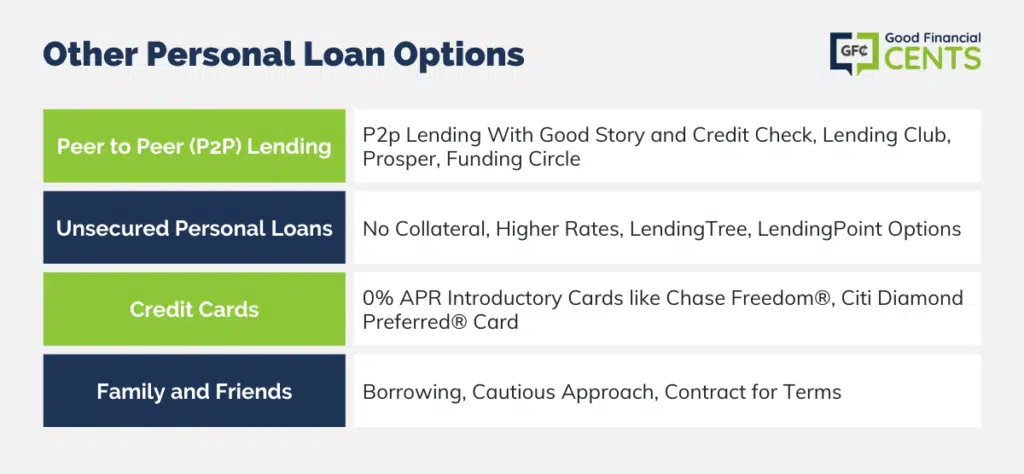

When it comes to obtaining a loan, self-employed individuals have various options to consider. Traditional banks, credit unions, and online lenders all offer different products tailored to the needs of freelancers and entrepreneurs. Here are some common types of loans you might explore:

1. **Personal Loans**: These can be used for various purposes and may have more lenient requirements than other types of loans.

2. **Business Loans**: If you need financing for your business, consider applying for a small business loan, which often takes into account your business’s revenue rather than just your personal income.

3. **SBA Loans**: The Small Business Administration (SBA) offers guaranteed loans for small businesses, which can be a great option for self-employed individuals.

4. **Peer-to-Peer Lending**: This alternative financing option connects borrowers with individual investors, often resulting in lower interest rates and more flexible terms.

Gathering Required Documentation

Once you've identified the type of loan you want to pursue, it's time to gather the necessary documentation. Lenders typically require:

- **Tax Returns**: Provide at least two years of personal and business tax returns to demonstrate your income stability.

- **Profit and Loss Statements**: These documents showcase your earnings and expenditures, helping lenders assess your financial health.

- **Bank Statements**: Recent bank statements can provide insight into your cash flow and spending habits.

- **Business Licenses and Permits**: If applicable, include any relevant licenses or permits that validate your business operations.

Choosing the Right Lender

Not all lenders are created equal. When considering how to get a loan when self employed, take the time to research and compare different lenders. Look for those who specialize in loans for self-employed individuals, as they may have more experience and understanding of your unique financial situation. Pay attention to interest rates, fees, and repayment terms to ensure you're making an informed decision.

Preparing for the Application Process

Before submitting your loan application, ensure that all your documents are organized and accurate. A well-prepared application can speed up the approval process and increase your chances of success. Be ready to explain your business model and how you plan to use the loan funds. Lenders appreciate borrowers who have a clear vision and a solid plan for repayment.

Securing a loan when self-employed may require more effort and preparation than for traditional employees, but it is entirely possible. By understanding your financial situation, improving your credit score, exploring different loan options, and preparing thorough documentation, you can increase your chances of obtaining the financing you need. Remember, the key is to present yourself as a responsible borrower with a clear plan for success. With determination and the right approach, you can unlock the financial opportunities that will help your business thrive.