# Unlock Your Financial Freedom with RSVP Loan: The Ultimate Guide to Smart Borrowing

## What is RSVP Loan?RSVP Loan is an innovative financial solution designed to cater to your unique borrowing needs. Whether you’re looking to consolidate d……

## What is RSVP Loan?

RSVP Loan is an innovative financial solution designed to cater to your unique borrowing needs. Whether you’re looking to consolidate debt, fund a special project, or cover unexpected expenses, RSVP Loan offers a flexible and convenient option that can help you achieve your financial goals. With competitive interest rates and personalized terms, RSVP Loan is becoming a popular choice for individuals seeking financial assistance.

## Why Choose RSVP Loan?

Choosing RSVP Loan means opting for a tailored approach to borrowing. Unlike traditional loans, RSVP Loan provides you with the flexibility to customize your loan terms to suit your financial situation. This means you can select the amount you need, the repayment period, and even the interest rate that works best for you.

### Benefits of RSVP Loan

1. **Flexible Terms**: RSVP Loan allows you to choose the repayment schedule that fits your lifestyle. Whether you prefer short-term or long-term repayment plans, you have the freedom to select what works best for you.

2. **Quick Approval Process**: One of the standout features of RSVP Loan is its fast approval process. With minimal documentation and online applications, you can receive approval within hours, allowing you to access funds when you need them most.

3. **Competitive Interest Rates**: RSVP Loan offers interest rates that are often lower than those of traditional banks. This means you can save money over the life of your loan, making it an economical choice for borrowers.

4. **No Hidden Fees**: Transparency is key with RSVP Loan. You won’t encounter any hidden fees or surprise charges, allowing you to plan your finances with confidence.

5. **Credit Score Flexibility**: RSVP Loan is designed to be accessible to a broader range of borrowers. Even if your credit score isn’t perfect, you may still qualify for a loan, making it an excellent option for those looking to rebuild their credit.

## How to Apply for RSVP Loan

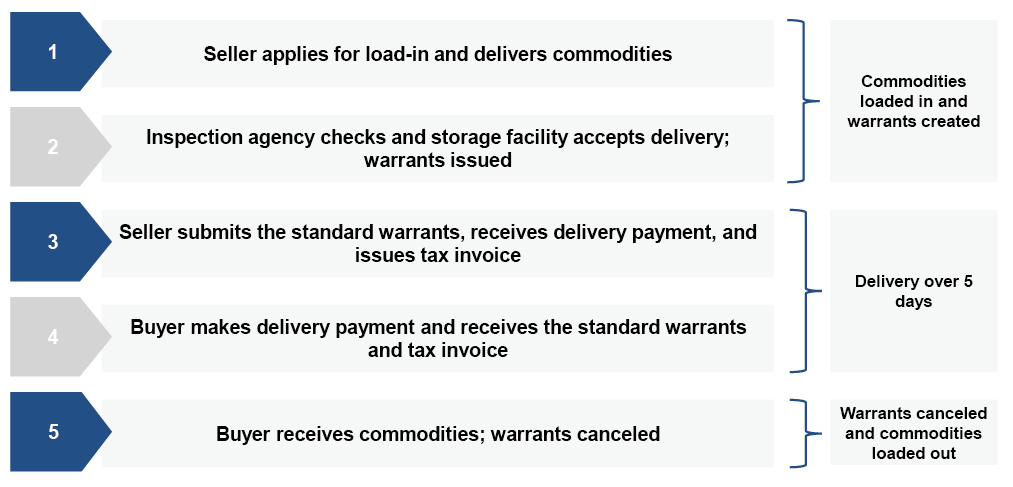

Applying for an RSVP Loan is a straightforward process. Here’s a step-by-step guide:

1. **Visit the Official Website**: Start by visiting the official RSVP Loan website to gather all necessary information and understand the loan options available.

2. **Fill Out the Application**: Complete the online application form, providing details about your financial situation, desired loan amount, and repayment preferences.

3. **Submit Required Documentation**: You may need to submit documents such as proof of income, identification, and other financial statements.

4. **Receive Approval**: After reviewing your application, RSVP Loan will provide a decision quickly, often within a few hours.

5. **Receive Your Funds**: Once approved, the funds will be deposited directly into your bank account, giving you immediate access to the money you need.

## Tips for Managing Your RSVP Loan

Once you’ve secured your RSVP Loan, managing it effectively is crucial. Here are some tips to help you stay on track:

- **Create a Budget**: Outline your monthly expenses and allocate funds for your loan repayment to avoid falling behind.

- **Set Up Automatic Payments**: To ensure you never miss a payment, consider setting up automatic withdrawals from your bank account.

- **Communicate with Your Lender**: If you encounter financial difficulties, reach out to your lender. They may offer solutions such as deferment or restructuring your loan.

## Conclusion

RSVP Loan is an appealing option for anyone in need of financial assistance. With its flexible terms, quick approval process, and competitive rates, it stands out as a smart borrowing solution. By understanding the benefits and effectively managing your loan, you can unlock the financial freedom you’ve been seeking. If you’re ready to take the next step, consider applying for an RSVP Loan today and pave your way to a brighter financial future!