Bad Credit Medical Loans: Your Path to Affordable Healthcare Financing

#### Description:Navigating the world of healthcare can be daunting, especially when financial constraints come into play. For many, unexpected medical expe……

#### Description:

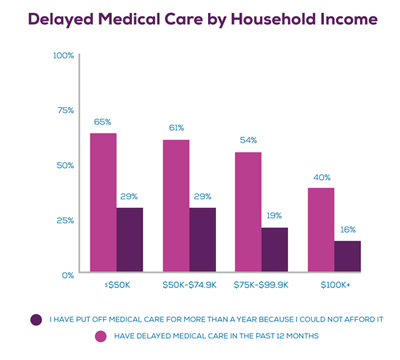

Navigating the world of healthcare can be daunting, especially when financial constraints come into play. For many, unexpected medical expenses can lead to a financial crisis, particularly for those with bad credit medical loans. Fortunately, there are options available that can help bridge the gap between urgent healthcare needs and financial limitations.

When faced with medical emergencies or necessary treatments, individuals with less-than-stellar credit scores often feel trapped. Traditional lenders may turn them away, leaving them with few options. However, bad credit medical loans are designed specifically to assist those who may not qualify for conventional financing. These loans cater to individuals who need immediate medical attention but lack the financial means to cover the costs upfront.

**Understanding Bad Credit Medical Loans**

So, what exactly are bad credit medical loans? These loans are personal loans specifically tailored for individuals with poor credit histories. They can be used to cover a variety of medical expenses, including emergency surgeries, dental work, prescription medications, or even elective procedures that insurance may not fully cover.

The appeal of bad credit medical loans lies in their accessibility. Many lenders who specialize in these types of loans understand that medical emergencies can happen to anyone, regardless of their credit score. As a result, they often have more flexible qualification criteria compared to traditional banks. This means that even if you have a low credit score or a history of late payments, you may still be able to secure funding for your medical needs.

**The Application Process**

Applying for bad credit medical loans is typically straightforward. Most lenders offer online applications that can be completed in a matter of minutes. You will need to provide some personal information, including your income, employment status, and details about your medical expenses.

Once you submit your application, lenders will review it and determine whether to approve your loan. If approved, you can often receive your funds quickly, sometimes even on the same day. This swift access to cash can be crucial when medical bills are piling up and immediate action is required.

**Interest Rates and Terms**

It's essential to be aware that while bad credit medical loans can provide quick relief, they may come with higher interest rates compared to traditional loans. Lenders take on more risk when lending to individuals with poor credit, and this is reflected in the terms of the loan. Therefore, it's crucial to read the fine print and understand the total cost of borrowing before committing to a loan.

To mitigate the impact of high-interest rates, consider shopping around for the best loan options. Some lenders might offer promotional rates or flexible repayment terms that could make your loan more manageable.

**Alternatives to Bad Credit Medical Loans**

While bad credit medical loans can be a lifesaver, they are not the only option available. If you're concerned about high-interest rates, consider other alternatives such as medical credit cards, payment plans offered by healthcare providers, or even negotiating your medical bills directly with hospitals or clinics.

Additionally, some non-profit organizations and charities offer financial assistance for specific medical conditions or treatments. Researching these options can help you find the best solution for your situation.

**Conclusion**

In summary, bad credit medical loans offer a viable solution for individuals facing unexpected medical expenses. They provide quick access to funds, allowing patients to receive the care they need without the burden of upfront costs. However, it is essential to approach these loans with caution, understanding the terms and potential financial implications. By exploring all available options, you can make informed decisions that prioritize both your health and financial well-being. Remember, you are not alone in this journey, and there are resources available to help you navigate your healthcare financing needs.