What is Forbearance Student Loan?

### Understanding Forbearance in Student Loans: A Comprehensive GuideIn the realm of student loans, borrowers often find themselves facing financial challen……

### Understanding Forbearance in Student Loans: A Comprehensive Guide

In the realm of student loans, borrowers often find themselves facing financial challenges that can make repayment difficult. This is where the concept of forbearance comes into play. But what is forbearance student loan, and how can it help you manage your educational debt? In this guide, we will explore the intricacies of forbearance, its types, eligibility criteria, and the potential implications on your financial future.

#### What is Forbearance Student Loan?

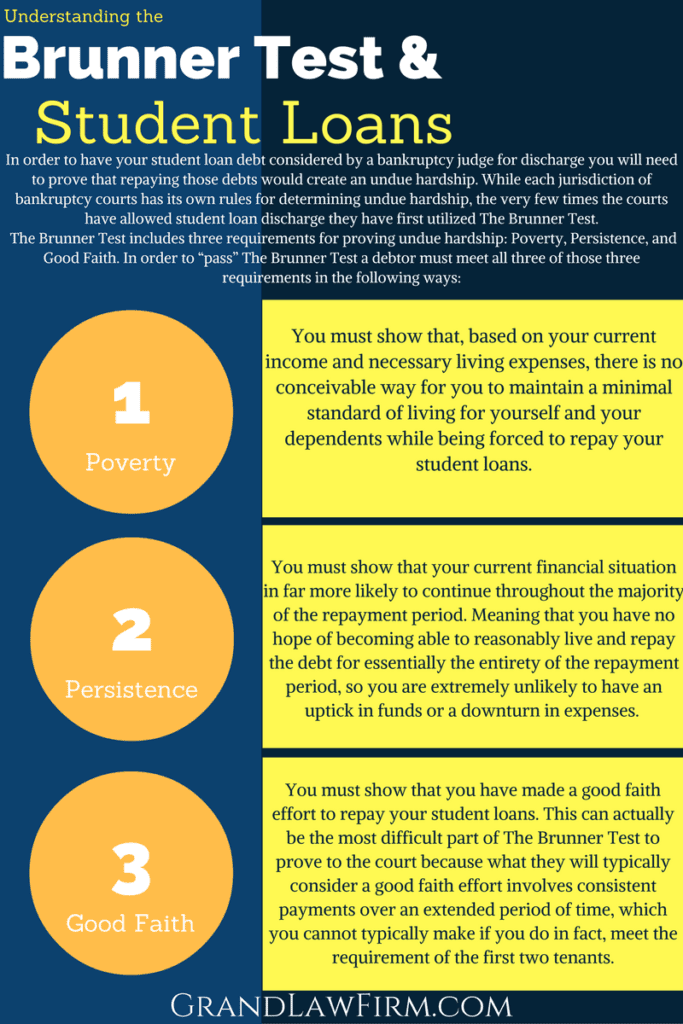

Forbearance is a temporary relief option offered to borrowers who are struggling to meet their student loan payments. It allows you to pause or reduce your payments for a specific period, typically ranging from a few months to a year. During this time, interest may continue to accrue on your loan balance, which can increase the total amount you owe over time. However, it provides crucial breathing room for borrowers who may be facing financial hardship due to unemployment, medical emergencies, or other unexpected circumstances.

#### Types of Forbearance

There are two primary types of forbearance available for student loans: discretionary and mandatory.

1. **Discretionary Forbearance**: This type is granted at the lender's discretion. Borrowers must demonstrate their financial difficulties, and the lender will decide whether to approve the request. Common reasons for discretionary forbearance include financial hardship, illness, or other personal issues that affect your ability to pay.

2. **Mandatory Forbearance**: This type is required by law for certain situations. If you meet specific criteria, such as being a member of the National Guard, serving in a medical internship, or experiencing a temporary financial hardship, your lender must grant you forbearance upon your request. Mandatory forbearance is a safeguard for borrowers who find themselves in challenging situations.

#### Eligibility for Forbearance

To qualify for forbearance, borrowers must meet certain criteria. While these criteria can vary by lender, some common eligibility requirements include:

- Demonstrating financial hardship or an inability to make the scheduled payments.

- Being enrolled in an eligible repayment plan.

- Providing necessary documentation to support your request.

It’s essential to communicate with your loan servicer to understand the specific requirements and gather the necessary information before applying for forbearance.

#### The Implications of Forbearance

While forbearance can provide temporary relief, it’s crucial to understand the long-term implications it can have on your student loans. Here are a few key points to consider:

- **Interest Accrual**: During forbearance, interest continues to accrue on your loans, which can significantly increase the total amount you owe. This is particularly important for unsubsidized loans, where the interest is not covered by the federal government during periods of forbearance.

- **Credit Impact**: Forbearance itself does not directly impact your credit score. However, if you miss payments before entering forbearance, your credit score may suffer. It’s essential to stay in communication with your lender and ensure your payments are manageable.

- **Future Repayment**: Once the forbearance period ends, you will need to resume payments, often at a higher amount due to accrued interest. This can lead to financial strain if you are still facing challenges.

#### Conclusion

In summary, understanding what is forbearance student loan is vital for borrowers navigating the complexities of student loan repayment. Forbearance can be a helpful tool for those experiencing temporary financial difficulties, but it’s essential to proceed with caution. Weigh the benefits against the potential long-term costs, and always communicate with your loan servicer to explore all available options. By staying informed and proactive, you can make the best decisions for your financial future and successfully manage your student loan obligations.