How to Find the Best Credit Union Car Loan Interest Rates

Guide or Summary:Interest RatesLoan Terms and ConditionsCommunity FocusIn the dynamic world of automotive financing, securing a credit union car loan stands……

Guide or Summary:

In the dynamic world of automotive financing, securing a credit union car loan stands out as a prudent choice for many borrowers. With competitive interest rates, favorable terms, and a strong commitment to community support, credit unions offer a compelling alternative to traditional banks and financial institutions. This guide delves into the intricate process of finding the best credit union car loan interest rates, ensuring that you make an informed decision that aligns with your financial goals and priorities.

Interest Rates

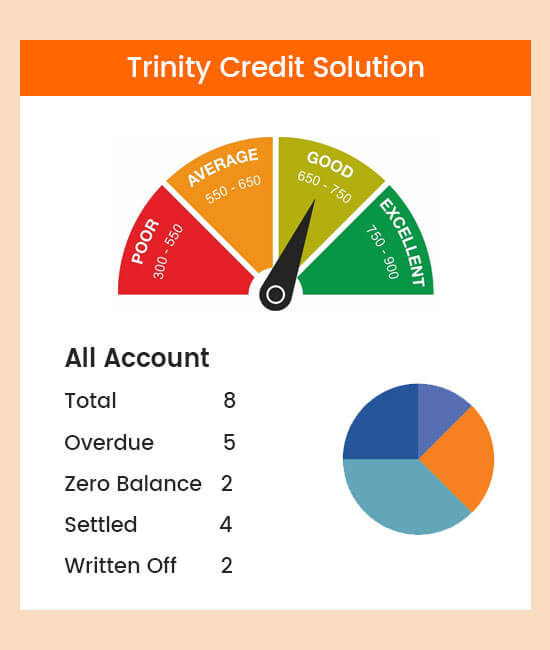

Understanding the intricacies of interest rates is crucial when seeking a credit union car loan. Interest rates, expressed as a percentage, represent the cost of borrowing money. They are influenced by various factors, including your credit score, the amount of the loan, and the term duration. Credit unions, known for their commitment to member satisfaction, often offer competitive interest rates that can be more favorable than those offered by banks.

To maximize your chances of securing the best credit union car loan interest rates, it's essential to compare rates from multiple credit unions. This process may involve conducting online research, visiting local credit union branches, and engaging in conversations with financial advisors. By diligently comparing interest rates, you can identify the most advantageous option that aligns with your financial situation.

Loan Terms and Conditions

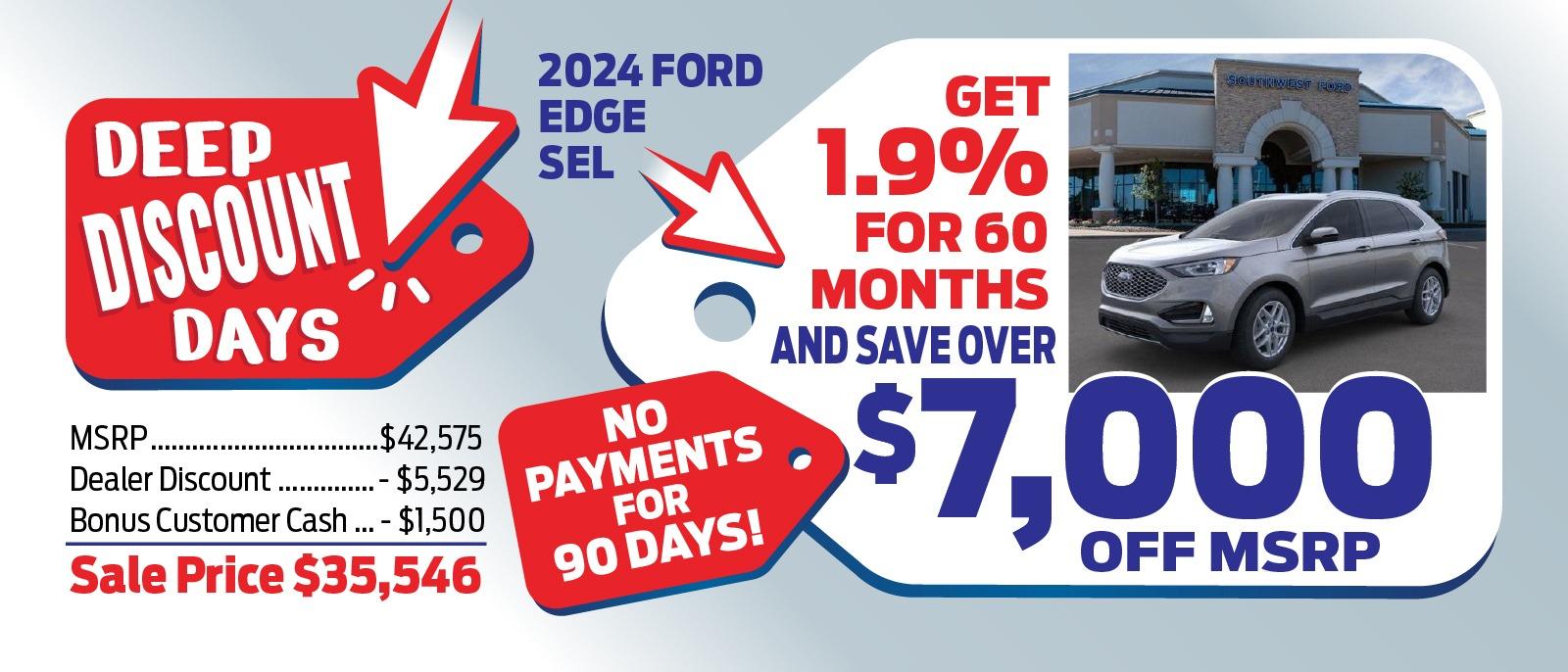

In addition to interest rates, loan terms and conditions play a vital role in determining the overall cost of a credit union car loan. These terms include the loan amount, repayment period, and any associated fees or charges. By carefully examining these terms, you can ensure that you are making a financially sound decision.

Credit unions often offer flexible loan terms that cater to the diverse needs of their members. Whether you're looking for a short-term loan to finance a quick purchase or a long-term loan to cover the costs of a new vehicle, credit unions provide a range of options to suit your specific requirements.

Community Focus

One of the most compelling aspects of credit unions is their strong commitment to community support. Unlike traditional banks, which prioritize profitability, credit unions operate on a not-for-profit basis, with a focus on serving the needs of their members. This community-centric approach often translates into lower interest rates and more favorable terms for borrowers.

When exploring credit union car loan options, it's important to consider the community focus of each institution. By choosing a credit union that aligns with your values and priorities, you can feel good about your financial decisions while also benefiting from competitive interest rates.

In the quest for the best credit union car loan interest rates, diligence and research are key. By carefully comparing rates, examining loan terms and conditions, and considering the community focus of each institution, you can make an informed decision that aligns with your financial goals and priorities. Whether you're in the market for a short-term loan or a long-term financing solution, credit unions offer a range of options that cater to the diverse needs of their members. With a commitment to community support and competitive interest rates, credit unions stand out as a prudent choice for anyone seeking reliable automotive financing.