Car Loan Rates for Used Cars: A Comprehensive Guide

Guide or Summary:Understanding Car Loan Rates for Used CarsFactors Influencing Car Loan Rates for Used CarsHow to Secure the Best Car Loan Rates for Used Ca……

Guide or Summary:

- Understanding Car Loan Rates for Used Cars

- Factors Influencing Car Loan Rates for Used Cars

- How to Secure the Best Car Loan Rates for Used Cars

In the bustling world of automotive financing, the subject of car loan rates for used cars stands out as a critical factor for prospective buyers. Whether you're upgrading your current vehicle or looking to purchase your first car, understanding the intricacies of used car loans is essential. This comprehensive guide delves into the various aspects of car loan rates for used cars, offering valuable insights to help you navigate the financing landscape with confidence.

Understanding Car Loan Rates for Used Cars

Car loan rates for used cars can vary significantly depending on several key factors. These include the make and model of the vehicle, its age and condition, your credit score, and the length of the loan term. Lenders evaluate these factors to determine the interest rate and the overall cost of borrowing money for your used car purchase.

Factors Influencing Car Loan Rates for Used Cars

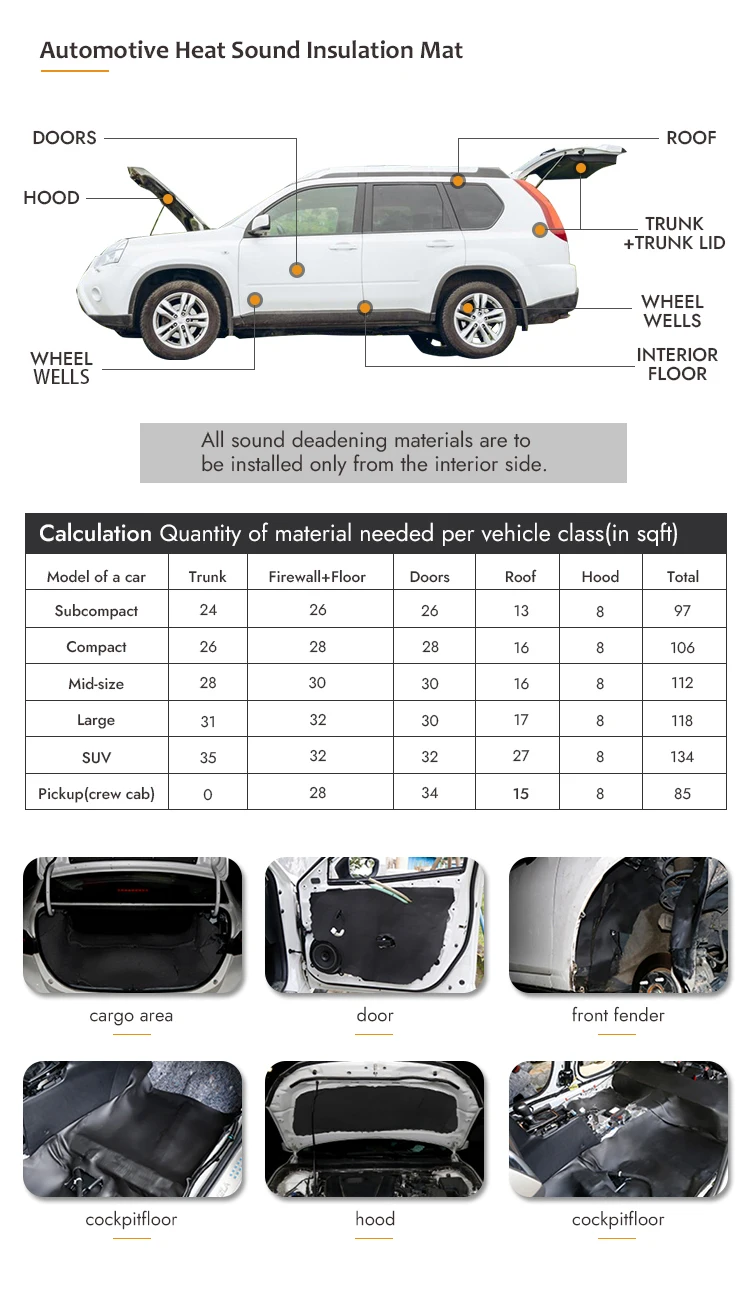

1. **Vehicle Condition and Age**: Generally, newer vehicles with lower mileage and good condition tend to have lower loan rates. Conversely, older vehicles with higher mileage may come with higher rates due to their potential for mechanical issues and depreciation.

2. **Credit Score**: Your credit score plays a crucial role in determining your car loan rates. A higher credit score typically translates into lower interest rates, while a lower score may result in higher rates.

3. **Loan Term**: The length of the loan term also impacts the interest rates. Longer loan terms usually come with lower monthly payments but higher overall interest costs. Shorter loan terms, on the other hand, result in higher monthly payments but lower interest costs over the lifetime of the loan.

4. **Down Payment**: A larger down payment can help improve your chances of securing a lower interest rate. It demonstrates your commitment to the loan and reduces the amount you need to borrow, thus lowering the overall cost of financing.

How to Secure the Best Car Loan Rates for Used Cars

1. **Shop Around**: Don't settle for the first offer you receive. Compare rates from multiple lenders to find the best deal. Use online tools and calculators to estimate your monthly payments and total interest costs.

2. **Improve Your Credit Score**: Aim to improve your credit score before applying for a car loan. Pay your bills on time, reduce your credit card balances, and avoid opening new credit accounts.

3. **Consider Pre-approval**: Getting pre-approved for a car loan can give you a better understanding of your borrowing capacity and position you as a more attractive borrower to lenders.

4. **Negotiate Fees and Rates**: Don't be afraid to negotiate with lenders. Ask about prepayment penalties, origination fees, and any additional charges. Sometimes, a little negotiation can lead to significant savings.

Navigating the world of car loan rates for used cars can be daunting, but with the right knowledge and approach, you can secure a favorable loan that fits your budget and financial goals. By understanding the factors that influence car loan rates, shopping around, improving your credit score, and considering pre-approval and negotiation, you can make informed decisions and find the best deal for your used car purchase. Remember, the goal is to find a loan that not only meets your financial needs but also provides peace of mind and flexibility for the future. Happy driving!