Loan Rates Calculator: Understanding and Utilizing the Loan Rates Calculator for Your Financial Planning

Guide or Summary:Introduction to the Loan Rates CalculatorWhy Utilize the Loan Rates Calculator?Key Features of the Loan Rates CalculatorStrategies for Util……

Guide or Summary:

- Introduction to the Loan Rates Calculator

- Why Utilize the Loan Rates Calculator?

- Key Features of the Loan Rates Calculator

- Strategies for Utilizing the Loan Rates Calculator

Title: Mastering the Art of Financial Planning: A Comprehensive Guide to Utilizing the Loan Rates Calculator for Optimal Interest Cost Savings

In the ever-evolving landscape of financial planning, one tool stands out as a beacon of clarity and cost savings: the loan rates calculator. Whether you're a seasoned investor or a novice looking to navigate the complexities of debt, understanding and utilizing this powerful tool can make all the difference in achieving your financial goals. This comprehensive guide delves deep into the intricacies of the loan rates calculator, offering insights and strategies to help you make informed decisions and optimize your interest cost savings.

Introduction to the Loan Rates Calculator

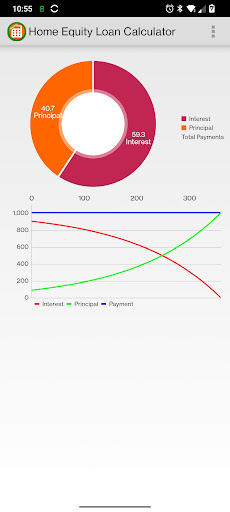

At its core, the loan rates calculator is a sophisticated financial tool designed to assist users in determining the most favorable loan terms based on various factors such as interest rates, loan amount, repayment period, and more. By inputting specific details into the calculator, users can receive a customized analysis of potential loan options, helping them to identify the best fit for their financial situation.

Why Utilize the Loan Rates Calculator?

The primary advantage of using a loan rates calculator is its ability to provide users with a clear, unbiased assessment of their loan options. By removing the guesswork and subjectivity from the loan selection process, the calculator empowers users to make informed decisions based on precise data analysis. This, in turn, leads to significant savings in interest costs and improved financial outcomes.

Key Features of the Loan Rates Calculator

To fully harness the power of the loan rates calculator, it is essential to understand its key features and functionalities. Some of the most notable features include:

- Customizable inputs: Users can input specific details such as loan amount, interest rates, repayment period, and more, allowing for a tailored analysis of potential loan options.

- Multiple loan types: The calculator supports a wide range of loan types, including mortgages, auto loans, personal loans, and more, ensuring that users can compare options across various categories.

- Scenario analysis: By allowing users to input different scenarios, such as varying interest rates or repayment periods, the calculator provides a comprehensive analysis of potential outcomes.

- Comparative analysis: The calculator offers side-by-side comparisons of different loan options, highlighting key differences such as interest rates, fees, and repayment terms.

Strategies for Utilizing the Loan Rates Calculator

To maximize the benefits of the loan rates calculator, it is crucial to adopt a strategic approach to its use. Some effective strategies include:

- Start with a clear objective: Before diving into the calculator, define your financial goals and objectives. This will help you to tailor your inputs and receive a more relevant analysis.

- Consider multiple scenarios: By exploring different scenarios, such as varying interest rates or repayment periods, you can identify the most favorable loan option for your specific financial situation.

- Compare and contrast: Take advantage of the calculator's comparative analysis feature to compare and contrast different loan options. This will help you to make informed decisions based on precise data analysis.

- Stay informed: Keep up-to-date with the latest loan rates and market trends to ensure that you are making the most informed decisions possible.

In today's complex financial landscape, the loan rates calculator stands as a powerful tool for optimizing your financial planning and achieving your financial goals. By understanding and utilizing this sophisticated financial tool, you can make informed decisions, save on interest costs, and secure a brighter financial future. So, why wait? Start mastering the art of financial planning today by utilizing the loan rates calculator to its fullest potential.