Loan to Income Ratio Mortgage Calculator - Mastering Your Mortgage Application with Precision

Guide or Summary:Mortgage Eligibility Simplified - Navigating the LTI with EaseCustomizing Your Mortgage Solution - Tailoring Your Loan to Fit Your IncomeTr……

Guide or Summary:

- Mortgage Eligibility Simplified - Navigating the LTI with Ease

- Customizing Your Mortgage Solution - Tailoring Your Loan to Fit Your Income

- Transparency and Education - Understanding Your Mortgage Application

- Streamlining the Application Process - Efficiency Made Easy

In the ever-evolving landscape of real estate and financing, the Loan to Income Ratio (LTI) plays a pivotal role in determining an applicant's eligibility for a mortgage. This metric, which compares the loan amount to the borrower's gross annual income, is a critical factor that lenders scrutinize meticulously. For prospective homeowners navigating the complexities of mortgage applications, the Loan to Income Ratio Mortgage Calculator emerges as a beacon of clarity and confidence. By harnessing the power of technology, this calculator empowers users to evaluate their mortgage options with precision, ensuring a smoother and more successful application process.

Mortgage Eligibility Simplified - Navigating the LTI with Ease

The Loan to Income Ratio Mortgage Calculator streamlines the mortgage application process by providing a straightforward means of assessing eligibility. With its user-friendly interface, the calculator allows applicants to input their personal financial details, including income, debt, and savings, to generate a clear and concise LTI ratio. This ratio, expressed as a percentage, is a direct indicator of an applicant's ability to repay the loan. By leveraging this tool, borrowers can gauge their financial standing, making informed decisions about their mortgage applications.

Customizing Your Mortgage Solution - Tailoring Your Loan to Fit Your Income

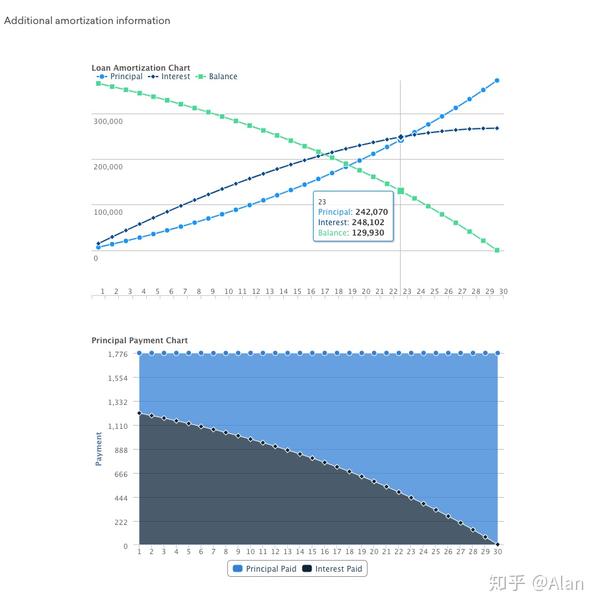

One of the calculator's most compelling features is its ability to customize mortgage solutions tailored to individual needs. By adjusting various parameters, such as loan amount, term length, and interest rate, users can explore different mortgage options that align with their financial goals and risk tolerance. This level of customization ensures that applicants find the most suitable mortgage package, maximizing their financial potential while minimizing their long-term obligations.

Transparency and Education - Understanding Your Mortgage Application

The Loan to Income Ratio Mortgage Calculator not only facilitates the mortgage application process but also serves as an educational resource for borrowers. By providing detailed explanations and insights into LTI calculations, the calculator demystifies the complexities of mortgage lending. This enhanced understanding empowers applicants to make informed decisions, ensuring they navigate the mortgage landscape with confidence.

Streamlining the Application Process - Efficiency Made Easy

In an era where time is of the essence, the Loan to Income Ratio Mortgage Calculator stands out for its efficiency. By automating the LTI calculation and presenting users with clear, actionable insights, the calculator significantly reduces the time and effort required for mortgage applications. This streamlined approach not only enhances the user experience but also accelerates the journey towards homeownership.

In conclusion, the Loan to Income Ratio Mortgage Calculator is a powerful tool that transforms the mortgage application process into a manageable and successful endeavor. With its emphasis on clarity, customization, education, and efficiency, this calculator emerges as an indispensable asset for anyone embarking on the journey to homeownership. By harnessing the power of technology, the Loan to Income Ratio Mortgage Calculator empowers users to navigate the complexities of mortgage lending with confidence, making the dream of homeownership a reality.