Student Credit Loan: A Smart Choice for College Success

Guide or Summary:Benefits of Student Credit LoansApplying for a Student Credit LoanImpact on Academic and Professional SuccessIn the ever-evolving landscape……

Guide or Summary:

- Benefits of Student Credit Loans

- Applying for a Student Credit Loan

- Impact on Academic and Professional Success

In the ever-evolving landscape of higher education, securing the financial resources necessary to pursue a degree has become a critical challenge. Amidst this complex financial puzzle, the concept of student credit loans emerges as a beacon of hope for countless students worldwide. This article delves into the intricacies of student credit loans, exploring their benefits, the application process, and how they can pave the way for academic and professional success.

Benefits of Student Credit Loans

One of the most compelling aspects of student credit loans is the flexibility they offer. Unlike fixed-rate loans or scholarships, which often come with strict eligibility criteria and limited funds, credit loans provide a tailored solution to individual financial needs. Students can borrow the exact amount required for tuition fees, books, and living expenses, ensuring that they have the financial freedom to focus on their studies.

Moreover, student credit loans typically come with favorable terms, including low-interest rates and extended repayment periods. This financial leniency allows students to manage their debt more effectively, reducing the burden of repayment in the long run. Additionally, many lenders offer deferment or income-based repayment plans, providing further relief during periods of financial hardship or after graduation.

Applying for a Student Credit Loan

The application process for a student credit loan is designed to be straightforward and accessible. Students typically need to provide basic financial information, such as income, employment status, and credit history. This information is used to assess the student's ability to repay the loan and determine the interest rate.

To increase the chances of approval, it is essential to maintain a good credit score and provide all necessary documentation promptly. Additionally, exploring various lenders and comparing loan terms can help students find the most suitable option for their financial situation.

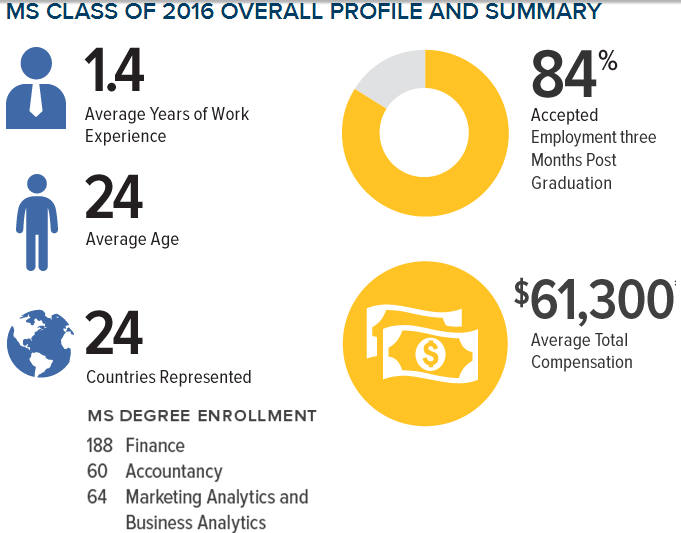

Impact on Academic and Professional Success

The financial security provided by student credit loans can have a profound impact on academic and professional success. Without the constant worry of financial constraints, students can fully immerse themselves in their studies, participate in extracurricular activities, and pursue internships or part-time jobs that enhance their skills and experiences.

Furthermore, the ability to access the necessary funds can open doors to advanced degrees or specialized programs, furthering academic and career aspirations. The financial stability afforded by student credit loans can also lead to more informed decision-making, allowing students to choose the right courses and opportunities that align with their long-term goals.

In conclusion, the student credit loan is a valuable financial tool that can significantly enhance the college experience. By providing flexibility, favorable terms, and financial freedom, student credit loans empower students to focus on their studies, pursue their passions, and build a strong foundation for their future careers. As higher education becomes increasingly accessible and affordable, the role of student credit loans in achieving academic and professional success will only continue to grow.