"Unlock the Best Deals: Understanding Auto Loan Rates Current in 2023"

#### Auto Loan Rates CurrentIn the ever-evolving landscape of automotive financing, understanding the auto loan rates current is crucial for potential car b……

#### Auto Loan Rates Current

In the ever-evolving landscape of automotive financing, understanding the auto loan rates current is crucial for potential car buyers. As of 2023, these rates can significantly influence your monthly payments and the overall cost of your vehicle. Whether you're looking to buy a new car or refinance an existing loan, staying informed about the latest rates can help you make the best financial decisions.

#### Factors Influencing Auto Loan Rates

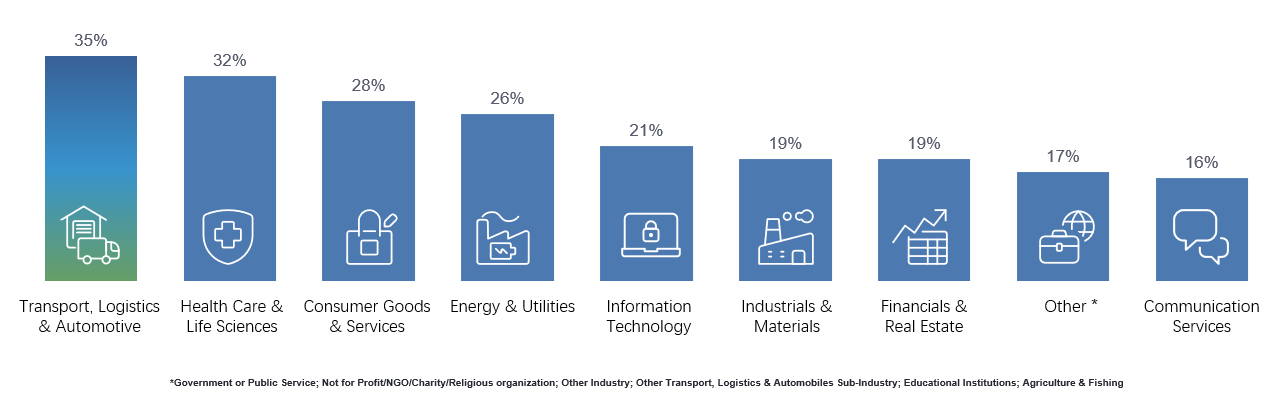

Several factors contribute to the auto loan rates current. Lenders assess your credit score, the type of vehicle, loan term, and even the economic climate. Generally, borrowers with higher credit scores can secure lower interest rates, while those with lower scores may face higher rates. Additionally, new cars often come with lower rates compared to used vehicles, as they are viewed as less risky by lenders.

#### Current Trends in Auto Loan Rates

As of 2023, auto loan rates current have seen fluctuations due to changes in the Federal Reserve's interest rates and the overall economic recovery post-pandemic. It's essential to monitor these trends, as they can impact your financing options. For instance, if the economy is strong and consumer demand for vehicles rises, lenders may increase their rates. Conversely, if the economy slows down, rates may decrease to stimulate borrowing.

#### How to Find the Best Auto Loan Rates

Finding the best auto loan rates current requires some research. Start by checking your credit score and improving it if necessary. Once you have a good score, shop around with different lenders, including banks, credit unions, and online lenders. Compare their offers, taking into account not just the interest rates but also any additional fees or terms that may apply.

#### Negotiating Your Auto Loan Rate

Once you've found a few potential lenders, don't hesitate to negotiate. Many dealerships and lenders may offer promotional rates, but it’s always worth asking if they can provide a better deal. Presenting competing offers can sometimes lead to lower rates or better terms. Remember, the goal is to secure the most favorable auto loan rates current that fit your financial situation.

#### Conclusion: Making Informed Decisions

In conclusion, understanding auto loan rates current is essential for anyone looking to finance a vehicle in 2023. By being aware of the factors that influence these rates and actively seeking the best deals, you can save money and make informed decisions. Regularly monitoring market trends and maintaining a good credit score will empower you in your journey to secure the best auto financing options available. Whether you're a first-time buyer or looking to refinance, staying informed will help you navigate the complex world of auto loans with confidence.