Understanding the Benefits of Fixed Rate HELOC Loans for Homeowners

Guide or Summary:Fixed Rate HELOC LoansWhat Makes Fixed Rate HELOC Loans Attractive?How to Qualify for Fixed Rate HELOC LoansUsing Fixed Rate HELOC Loans Wi……

Guide or Summary:

- Fixed Rate HELOC Loans

- What Makes Fixed Rate HELOC Loans Attractive?

- How to Qualify for Fixed Rate HELOC Loans

- Using Fixed Rate HELOC Loans Wisely

Fixed Rate HELOC Loans

A Fixed Rate HELOC (Home Equity Line of Credit) loan is a financial product that allows homeowners to borrow against the equity in their homes at a stable, fixed interest rate. Unlike traditional home equity loans that provide a lump sum, a HELOC offers a revolving line of credit that can be accessed as needed, making it a flexible option for managing finances.

What Makes Fixed Rate HELOC Loans Attractive?

One of the primary advantages of Fixed Rate HELOC loans is the predictability they offer. Homeowners can budget effectively without worrying about fluctuating interest rates that can significantly increase monthly payments. This stability is particularly appealing in times of economic uncertainty when variable rates might rise unexpectedly.

Additionally, Fixed Rate HELOC loans often come with lower interest rates compared to other forms of credit, such as credit cards or personal loans. This makes them an attractive option for those looking to consolidate debt or finance home improvements. The ability to borrow against the equity in a home means that homeowners can access large sums of money at a lower cost, making it a smart financial move for many.

How to Qualify for Fixed Rate HELOC Loans

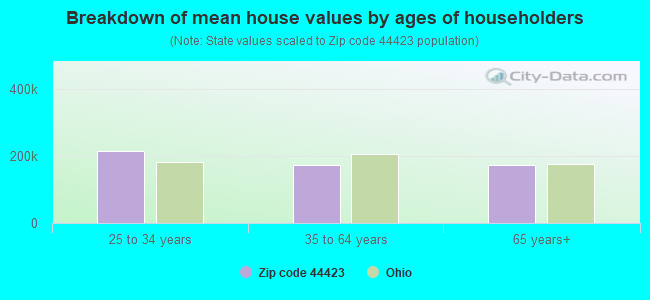

Qualifying for a Fixed Rate HELOC loan typically involves several factors. Lenders will assess the homeowner's credit score, income, debt-to-income ratio, and the amount of equity in the home. Generally, a credit score of 620 or higher is preferred, although some lenders may be more flexible. The amount of equity required can vary, but most lenders look for at least 15-20% equity in the home.

It's also essential for homeowners to shop around and compare offers from different lenders. Terms and conditions can vary significantly, and finding the right lender can lead to better rates and lower fees.

Using Fixed Rate HELOC Loans Wisely

Once approved for a Fixed Rate HELOC loan, homeowners should use the funds wisely. Common uses include home renovations, debt consolidation, or funding education expenses. However, it’s crucial to avoid using the funds for non-essential purchases, as this can lead to financial strain down the line.

Homeowners should also develop a repayment plan to ensure they can pay off the borrowed amount without jeopardizing their financial stability. Since the loan is secured by the home, failing to make payments can lead to foreclosure, making it essential to treat this financial tool with caution.

In conclusion, Fixed Rate HELOC loans offer a flexible and stable borrowing option for homeowners looking to leverage their home equity. With the ability to access funds at a fixed interest rate, these loans can be a valuable resource for managing expenses and achieving financial goals. However, it's essential for homeowners to understand the responsibilities that come with borrowing against their home and to use this financial tool wisely to avoid potential pitfalls. By doing so, they can make the most of their Fixed Rate HELOC loans and enhance their financial well-being.