"Unlock Financial Freedom: How a Cash Advancement Loan Can Help You Overcome Unexpected Expenses"

#### Understanding Cash Advancement LoansA cash advancement loan, also known as a cash advance loan, is a short-term borrowing option that allows individual……

#### Understanding Cash Advancement Loans

A cash advancement loan, also known as a cash advance loan, is a short-term borrowing option that allows individuals to access quick cash to cover urgent financial needs. These loans are typically unsecured, meaning you don’t need to provide collateral, and they are designed to help borrowers manage unexpected expenses, such as medical bills, car repairs, or emergency home repairs.

#### The Benefits of Cash Advancement Loans

One of the main advantages of a cash advancement loan is the speed of approval and funding. Many lenders offer online applications that can be completed in just a few minutes, and you can often receive funds within the same day or the next business day. This makes cash advancement loans an excellent option for those who need immediate financial relief.

Additionally, cash advancement loans are accessible to a wide range of borrowers, including those with less-than-perfect credit. While traditional loans may require a good credit score and a lengthy approval process, cash advancement loans often have more lenient requirements, making them an appealing choice for individuals facing financial difficulties.

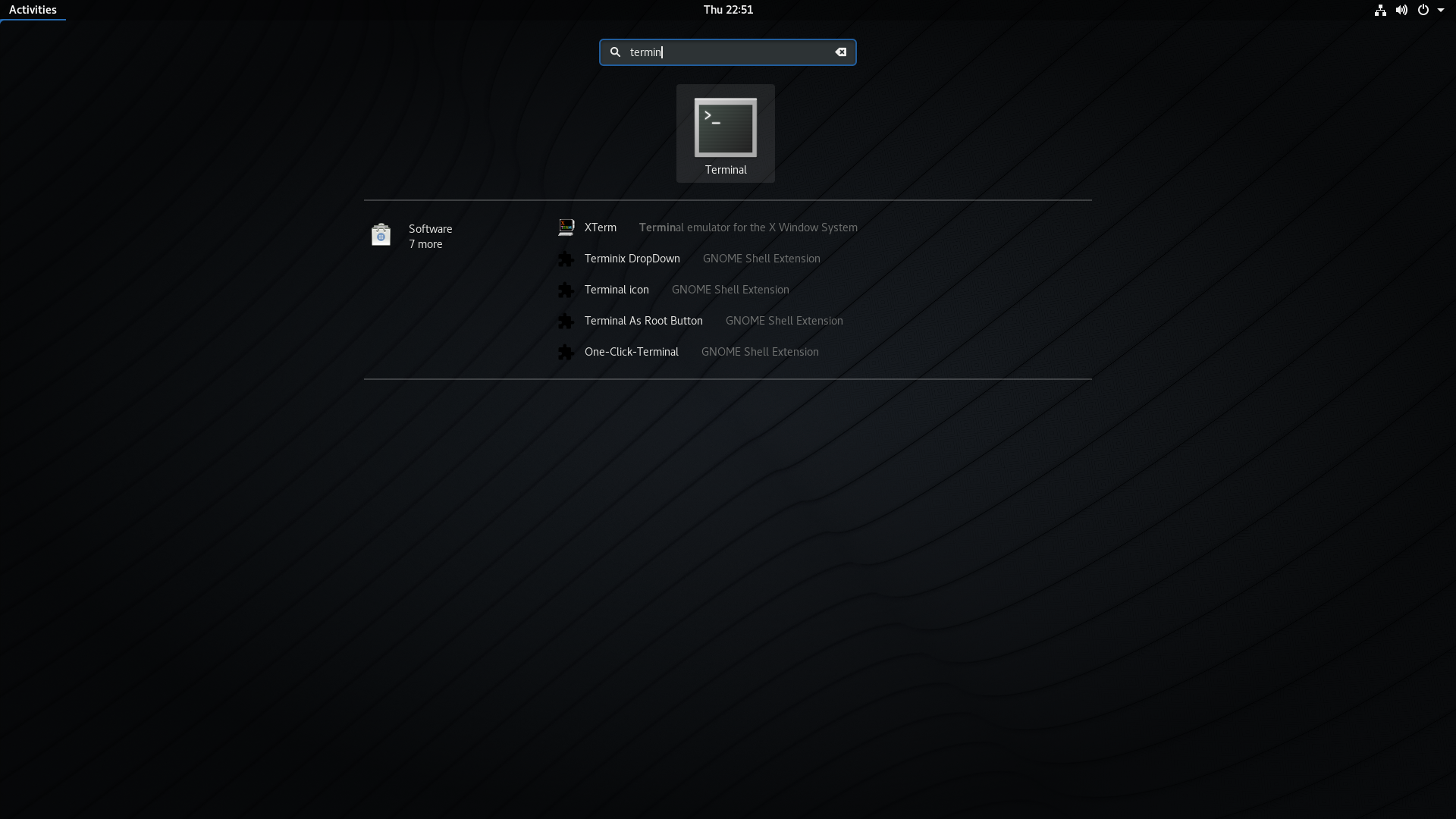

#### How to Apply for a Cash Advancement Loan

Applying for a cash advancement loan is typically a straightforward process. Most lenders will require you to provide basic personal information, proof of income, and details about your bank account. It’s essential to shop around and compare different lenders to find the best interest rates and terms. Some lenders may offer promotional rates or discounts for first-time borrowers, which can help reduce the overall cost of the loan.

Before applying, it’s crucial to assess your financial situation and determine how much money you need to borrow. Cash advancement loans can be convenient, but they often come with high-interest rates and fees. Therefore, it’s vital to borrow only what you can afford to repay.

#### Considerations Before Taking a Cash Advancement Loan

While cash advancement loans can provide quick relief, they are not without risks. Borrowers should be aware of the potential for falling into a cycle of debt if they are unable to repay the loan on time. Missing payments can lead to additional fees and increased interest rates, making it even more challenging to pay off the debt.

It’s also essential to read the fine print and understand the terms and conditions of the loan before signing any agreements. Some lenders may have hidden fees or unfavorable repayment terms that can complicate your financial situation.

#### Alternatives to Cash Advancement Loans

If you’re hesitant about taking out a cash advancement loan, there are alternative options to consider. For example, you might explore personal loans from credit unions or banks, which may offer lower interest rates and more favorable terms. Additionally, you could consider borrowing from friends or family, or even negotiating payment plans with service providers to alleviate immediate financial pressure.

In conclusion, a cash advancement loan can be a valuable financial tool for managing unexpected expenses, but it’s essential to approach it with caution. By understanding the benefits and risks, and exploring alternative options, you can make informed decisions that align with your financial goals. Always remember to borrow responsibly and ensure that you have a plan in place for repayment to avoid potential pitfalls.