Understanding the Home Loan Pre Approval Process: A Comprehensive Guide to Securing Your Dream Home

#### Home Loan Pre Approval ProcessThe home loan pre approval process is a crucial step for anyone looking to purchase a home. This process allows potential……

#### Home Loan Pre Approval Process

The home loan pre approval process is a crucial step for anyone looking to purchase a home. This process allows potential homebuyers to understand how much they can borrow before they start house hunting. It involves a lender evaluating your financial situation, including your credit score, income, debts, and assets, to determine the maximum loan amount you qualify for.

#### Why is Pre Approval Important?

Getting pre-approved for a home loan is important for several reasons. First, it gives you a clear idea of your budget, which helps you narrow down your search to homes that you can afford. Second, it shows sellers that you are a serious buyer, which can give you an edge in competitive markets. When you make an offer on a home, having a pre-approval letter can make your bid more attractive compared to others who may not have secured financing.

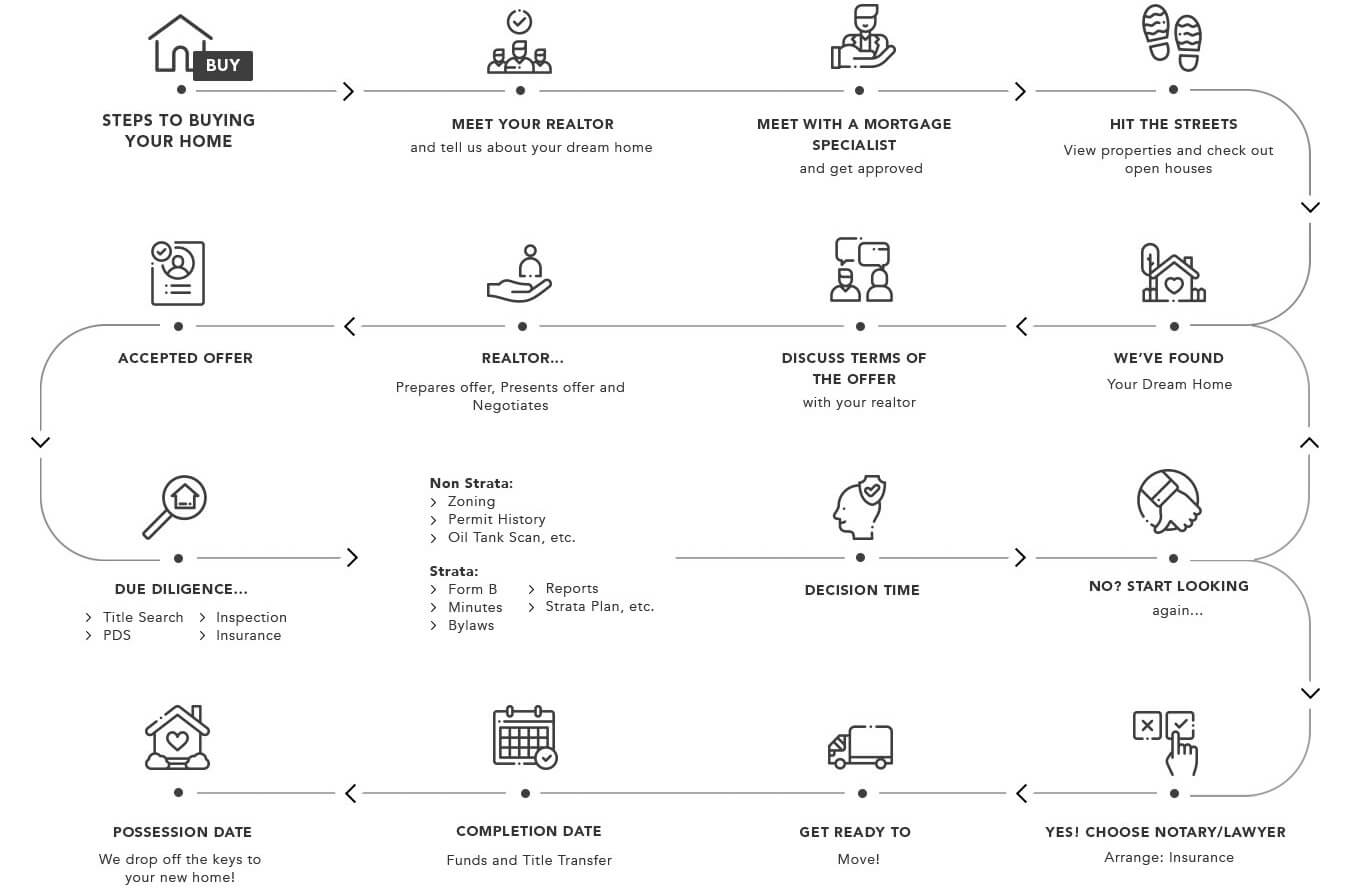

#### The Steps Involved in the Pre Approval Process

1. **Gather Financial Documents**: The first step in the home loan pre approval process is to gather all necessary financial documents. This typically includes your W-2 forms, pay stubs, bank statements, and tax returns for the past two years.

2. **Complete a Loan Application**: Once you have your documents ready, you will need to fill out a loan application. This can often be done online, and it will require you to provide information about your employment, income, debts, and assets.

3. **Credit Check**: After submitting your application, the lender will conduct a credit check. Your credit score plays a significant role in determining your eligibility for a loan and the interest rate you will receive.

4. **Loan Underwriting**: If your application meets the lender's criteria, it will go through the underwriting process. An underwriter will review your financial information and assess the risk of lending to you.

5. **Receive Pre Approval Letter**: If everything checks out, you will receive a pre-approval letter stating the amount you are qualified to borrow. This letter is typically valid for 60 to 90 days, depending on the lender.

#### Tips for a Smooth Pre Approval Process

- **Check Your Credit Score**: Before applying for pre-approval, check your credit score and report for any errors or issues that could affect your application.

- **Keep Your Finances Stable**: Avoid making any significant financial changes, such as taking on new debts or changing jobs, during the pre-approval process.

- **Be Honest with Your Lender**: Provide accurate information on your application. Any discrepancies can lead to delays or denial of your pre-approval.

#### Conclusion

The home loan pre approval process is an essential step in the home buying journey. By understanding the steps involved and preparing accordingly, you can increase your chances of securing the financing you need to purchase your dream home. With a pre-approval letter in hand, you’ll be well-equipped to make informed decisions and negotiate effectively in the competitive real estate market.